The digital payments landscape is rapidly evolving, driven by technological advancements and changing consumer preferences. As we look towards 2025, several key trends are shaping the future of digital payments, including contactless payments, cryptocurrency transactions, and mobile payment solutions https://intececologico.com/. Digital payments in 2025: current trends and predictions for the future, offering insights on how businesses and consumers can prepare for these impending changes.

Cryptocurrency is no longer just a buzzword. It’s becoming a viable payment option for many businesses. As more companies start accepting Bitcoin and other cryptocurrencies, we can expect a significant shift in how transactions are conducted.

The best technology always wins in payments, because it has to. You can get away with making a bad pizza once in a while. But if your payments system goes down, even for a day, that could be the end of your business.

While some of the trends, such as the industry’s move toward instant payments, will remain on a steady trajectory, others are expected to emerge as more important, including the use of artificial intelligence.

Regulatory developments like the EU’s Payment Services Directive 3 (PSD3) and Payment Services Regulation (PSR) are set to reshape the payments industry. These frameworks aim to enhance security, streamline open banking, and provide consumers with greater control over their data. Key highlights include:

You might have a project that utilizes blockchain technology to control the flow of goods. We can imagine a shipping company here. They have developed a blockchain program for logistics management, a program that relies on the creation and transfer of tokens in order to keep track of inventory.

Finally, cryptocurrencies differ greatly in terms of their general acceptance. Once again, Bitcoin is the standard. It is the most widely accepted cryptocurrency around the world. If you run across any online or brick-and-mortar merchant willing to accept cryptocurrency, it is likely that merchant accepts Bitcoin – even if other cryptos are accepted alongside it.

You might have a project that utilizes blockchain technology to control the flow of goods. We can imagine a shipping company here. They have developed a blockchain program for logistics management, a program that relies on the creation and transfer of tokens in order to keep track of inventory.

Finally, cryptocurrencies differ greatly in terms of their general acceptance. Once again, Bitcoin is the standard. It is the most widely accepted cryptocurrency around the world. If you run across any online or brick-and-mortar merchant willing to accept cryptocurrency, it is likely that merchant accepts Bitcoin – even if other cryptos are accepted alongside it.

Financial tokens are digital assets that support economic activities such as lending, borrowing, trading, and yield generation within decentralised finance (DeFi) ecosystems. These tokens often represent access to specific financial services, act as incentives for participation, or enable protocol-level fee structures. Many of them are native to DeFi platforms and play a central role in shaping on-chain financial products.

While there are thousands of cryptocurrencies out there, ranging from the big hitters (Bitcoin) to the ridiculous (Dogecoin, also known as the first meme coin), cryptocurrencies can be grouped into four basic categories:

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

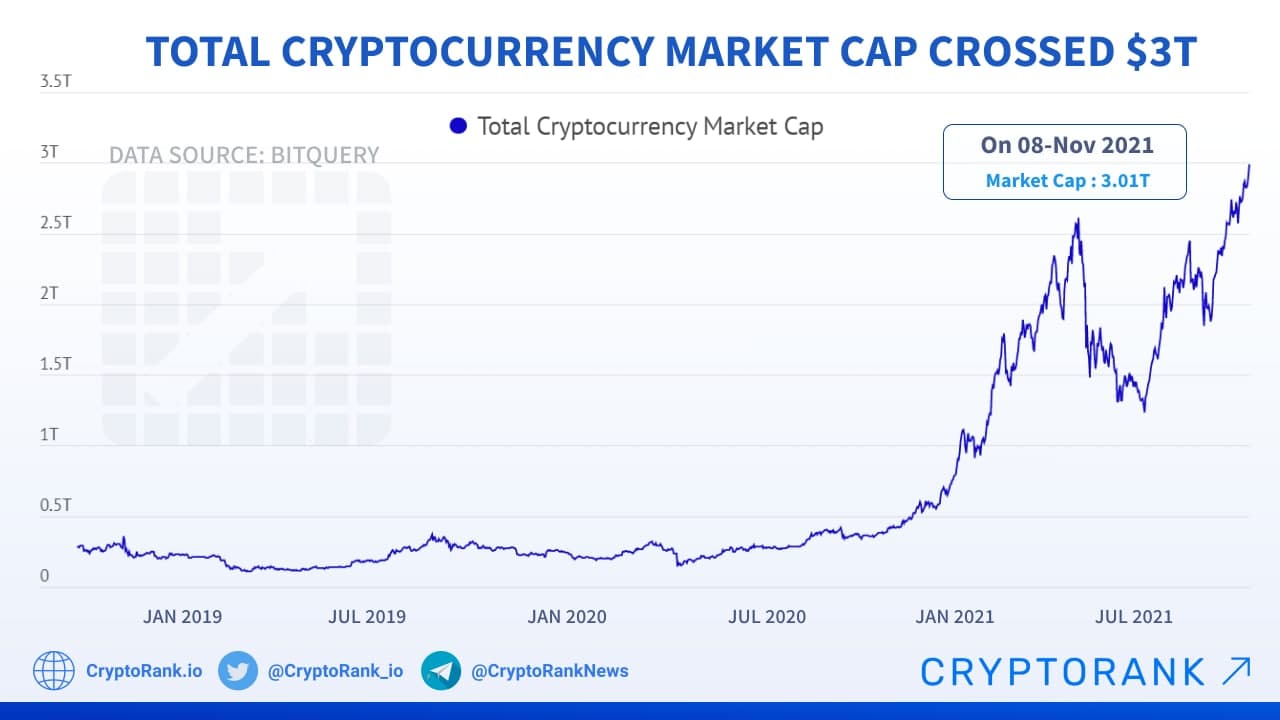

The top 10 cryptocurrencies are ranked by their market capitalization. Even though 10 is an arbitrarily selected number, being in the top 10 by market capitalization is a sign that the cryptocurrency enjoys a lot of relevance in the crypto market. The crypto top 10 changes frequently because of the high volatility of crypto prices. Despite this, Bitcoin and Ethereum have been ranked #1 and #2, respectively, for several years now.

The circulating supply of a cryptocurrency is the amount of units that is currently available for use. Let’s use Bitcoin as an example. There is a rule in the Bitcoin code which says that only 21 million Bitcoins can ever be created. The circulating supply of Bitcoin started off at 0 but immediately started growing as new blocks were mined and new BTC coins were being created to reward the miners. Currently, there are around 19.86 million Bitcoins in existence, and this number will keep growing until the 21 millionth BTC is mined. Since 19.86 million BTC have been mined so far, we say that this is the circulating supply of Bitcoin.

Play-to-earn (P2E) games, also known as GameFi, has emerged as an extremely popular category in the crypto space. It combines non-fungible tokens (NFT), in-game crypto tokens, decentralized finance (DeFi) elements and sometimes even metaverse applications. Players have an opportunity to generate revenue by giving their time (and sometimes capital) and playing these games.

The top 10 cryptocurrencies are ranked by their market capitalization. Even though 10 is an arbitrarily selected number, being in the top 10 by market capitalization is a sign that the cryptocurrency enjoys a lot of relevance in the crypto market. The crypto top 10 changes frequently because of the high volatility of crypto prices. Despite this, Bitcoin and Ethereum have been ranked #1 and #2, respectively, for several years now.

The circulating supply of a cryptocurrency is the amount of units that is currently available for use. Let’s use Bitcoin as an example. There is a rule in the Bitcoin code which says that only 21 million Bitcoins can ever be created. The circulating supply of Bitcoin started off at 0 but immediately started growing as new blocks were mined and new BTC coins were being created to reward the miners. Currently, there are around 19.86 million Bitcoins in existence, and this number will keep growing until the 21 millionth BTC is mined. Since 19.86 million BTC have been mined so far, we say that this is the circulating supply of Bitcoin.